Find the best bank account for you

Savings account

CIBC eAdvantage® Savings Account

Get RDS%rate[3].CESA.Published(null,0.0_and over_0.0_CAD_Bonus,1,1)(#O2#)%ⓘ interest for 3 months. Limits apply.

Save without the effort.

- Regular interestⓘ on every dollar

- Smart Interest when you save $200 or more in a month, limits applyⓘ

- Automatic transfers with AutoSave

$0 monthly fee

Savings account

CIBC eAdvantage® Savings Account

Get RDS%rate[3].CESA.Published(null,0.0_and over_0.0_CAD_Bonus,1,1)(#O2#)%ⓘ interest for 3 months. Limits apply.

Save without the effort.

- Regular interestⓘ on every dollar

- Smart Interest when you save $200 or more in a month, limits applyⓘ

- Automatic transfers with AutoSave

$0 monthly fee

Savings account

CIBC eAdvantage® Savings Account

Get RDS%rate[3].CESA.Published(null,0.0_and over_0.0_CAD_Bonus,1,1)(#O2#)%ⓘ interest for 3 months. Limits apply.

Save without the effort.

- Regular interestⓘ on every dollar

- Smart Interest when you save $200 or more in a month, limits applyⓘ

- Automatic transfers with AutoSave

$0 monthly fee

Chequing account

CIBC Everyday® Chequing Account

A basic account with no monthly feeⓘ for seniors over 65.

- 18 transactionsⓘ, ⓘ included monthly, $1.25 for each transaction over 18

- No fee for using Interac e-Transferⓘ, included in monthly fee

- Our low-cost account commitment to Canadian consumers

$0 monthly feeⓘ

Savings account

CIBC eAdvantage® Savings Account

Get RDS%rate[3].CESA.Published(null,0.0_and over_0.0_CAD_Bonus,1,1)(#O2#)%ⓘ interest for 3 months. Limits apply.

Get rewarded as you grow your savings.

- Regular interestⓘ on every dollar

- Smart Interest when you save $200 or more in a month, limits applyⓘ

- Automatic transfers with AutoSave

$0 monthly fee

Savings account

CIBC US$ Personal Account

Ideal for people who want to save and earn interest on U.S. funds.

- No monthly fee

- Regular interest on every dollar savedⓘ

- No currency conversion for depositing and withdrawing U.S. funds

$0 monthly fee

Looking for something different?

Are you an RDSP beneficiary?

You may be eligible for a monthly fee rebate on your CIBC Smart Account. Learn more about the Registered Disability Savings Plan..

Get more for your money

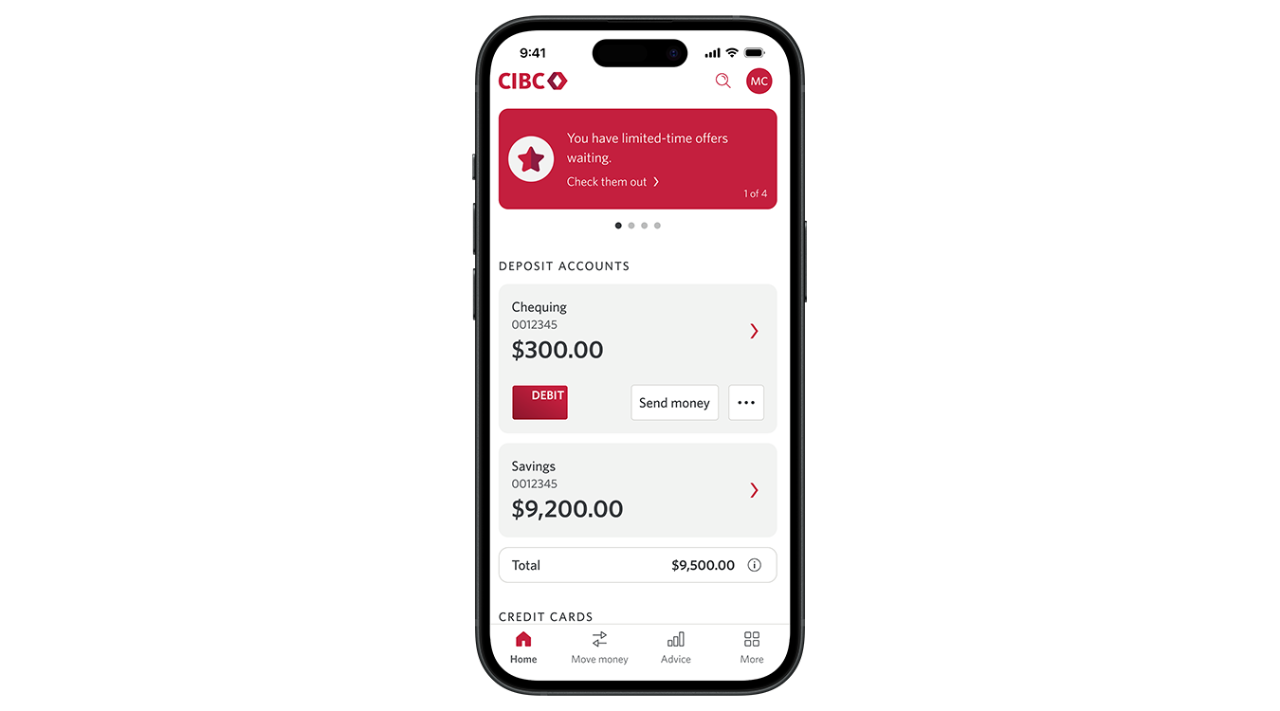

Bank your way

Manage your accounts with CIBC Mobile Banking® and CIBC Online Banking® and find CIBC Banking Centres and ATMs across Canada.

Get digital access within minutesⓘ

Apply online and access your bank account instantly. You can also add your debit card to your mobile wallet and start shopping on the first day.

Enjoy expert support

Get the most from your accounts with our specialized tips and guidance. We can help steer your finances in the right direction.

Save everyday with rewards and discounts

Save up to 10 cents per litre on gas with Journie

Link and use your CIBC card with Journie Rewards to save on gas at participating Pioneer, Fas Gas, Ultramar and Chevron locations.

Unlock the best of student life with SPC+

Students can save on everyday purchases with a free SPC+ membership.ⓘ

Get 30 days of free Koodo service as a newcomerⓘ

Plus, receive exclusive offers when you sign up with Koodo during your 30-day free trial.

Help and advice

Find the support you need

Discover answers to frequently asked questions or find the right number so we can support you.

Learn how to manage your banking

We have how-to guides for you. Check out what you can do on your computer, phone or tablet.

Understand how to save on account fees

Learn tips to ensure you find the right account, including options to help you reduce your everyday banking fees.

Resources

Your bank account questions answered

Commitment on low-cost and no-cost accounts

We’re committed to providing access to modern basic banking services for certain groups at low cost or no cost. Our low cost account is the CIBC Everyday Chequing Account. We offer fee rebates on the CIBC Smart Account for the following groups: seniorsⓘ, youth and students under 25ⓘ, students age 25 and upⓘ, newcomersⓘ, foreign workersⓘ, RDSP beneficiaries and recipients of the Disability Tax Credit. Applies to all CIBC Smart Accounts, no minimum balance required.