Get more for your money with our chequing accounts

Save on fees

Unlock monthly fee rebates on up to 3 CIBC Smart Accountsⓘ, ⓘ when you meet daily balance requirements or average monthly balanceⓘ requirements. Learn more about tiered banking.

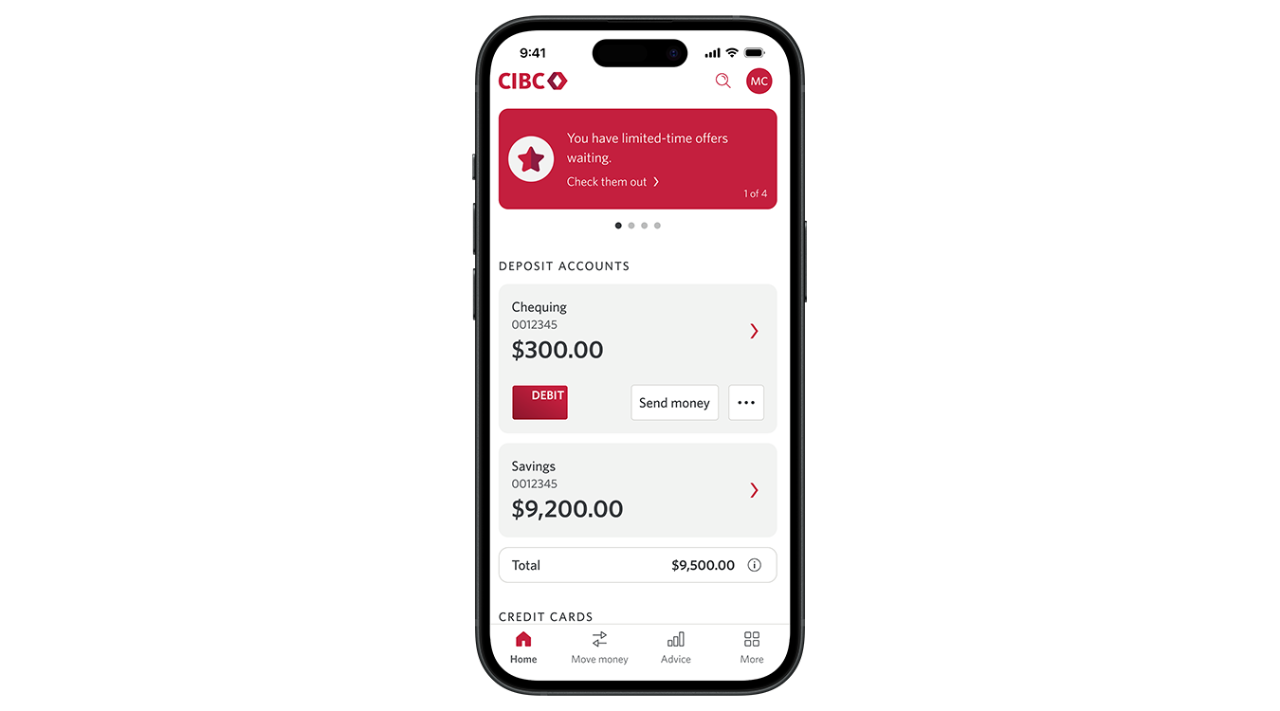

Get digital access within minutesⓘ

Apply online and access your bank account instantly, plus add your debit card to your mobile wallet and start shopping the same day.

Save money with rewards and discounts

Get exclusive offers with our partners including Skip, Journie Rewards and Paymi.

Find the chequing account that’s right for you

CIBC Smart® Account

Bundle to earn up to $950 $ⓘ, ⓘ. Conditions apply.

Get rewarded and save with our partners

Get a 12-month Skip+ free trial when you link your CIBC credit or debit card.ⓘ

Students can save on everyday purchases with a free SPC+ membership.ⓘ

Newcomers and international students can get 30 days of free Canada-wide Koodo service with a CIBC account.ⓘ

Get rewarded and save with our partners

Get a 12-month Skip+ free trial when you link your CIBC credit or debit card.ⓘ

Students can save on everyday purchases with a free SPC+ membership.ⓘ

Newcomers and international students can get 30 days of free Canada-wide Koodo service with a CIBC account.ⓘ

Get rewarded and save with our partners

Get a 12-month Skip+ free trial when you link your CIBC credit or debit card.ⓘ

Students can save on everyday purchases with a free SPC+ membership.ⓘ

Newcomers and international students can get 30 days of free Canada-wide Koodo service with a CIBC account.ⓘ

Get rewarded and save with our partners

Get a 12-month Skip+ free trial when you link your CIBC credit or debit card.ⓘ

Students can save on everyday purchases with a free SPC+ membership.ⓘ

Newcomers and international students can get 30 days of free Canada-wide Koodo service with a CIBC account.ⓘ

Looking for something else?

Are you an RDSP beneficiary?

You may be eligible for a monthly fee rebate on your CIBC Smart Account. Learn more about the Registered Disability Savings Plan..

Help and advice

Find the support you need

Discover answers to frequently asked questions or find the right number so we can support you.

Learn how to manage your banking

We have how-to guides for you. Check out what you can do on your computer, phone or tablet.

Understand how to save on account fees

Learn tips to ensure you find the right account, including options to help you reduce your everyday banking fees.

Resources

Your chequing account questions answered

Commitment on low-cost and no-cost accounts

We’re committed to providing access to modern basic banking services for certain groups at low cost or no cost. Our low cost account is the CIBC Everyday Chequing Account. We offer fee rebates on the CIBC Smart Account for the following groups: seniorsⓘ, youth and students under 25ⓘ, students age 25 and upⓘ, newcomersⓘ, foreign workersⓘ, RDSP beneficiaries and recipients of the Disability Tax Credit. Applies to all CIBC Smart Accounts, no minimum balance required.