Make banking the easy part of your journey

Start off strong with the essentials

Manage your money the smart way

The essentials

CIBC Everyday Business Operating Account®

Monthly fee1

$0

or

$20 for self-service2 access

$25 for full-service3, 4 access

Pay no monthly fee when you have a minimum daily balance of $20,0005

Transactions included6

30

(includes Interac e-Transfer® transactions7)

CIBC bizline® Visa* Card

Keep your personal and business expenses separate, build your business credit history and pay low interestrates

Annual fee

$0

(Up to 9 cardholders)

Interest rate

As low as CIBC Prime + 1.5% for purchases8

As low as CIBC Prime + 1.5% for cash8

Minimum annual income

$35,000

(individual)

Your operating account and credit card questions answered

Run your business smoothly with a little help from us

Start or grow your business with our new Black Entrepreneur Program Loan

Apply for up to $150,000◇◇ in financing. Access expert advice and read inspiring stories from business owners like you.

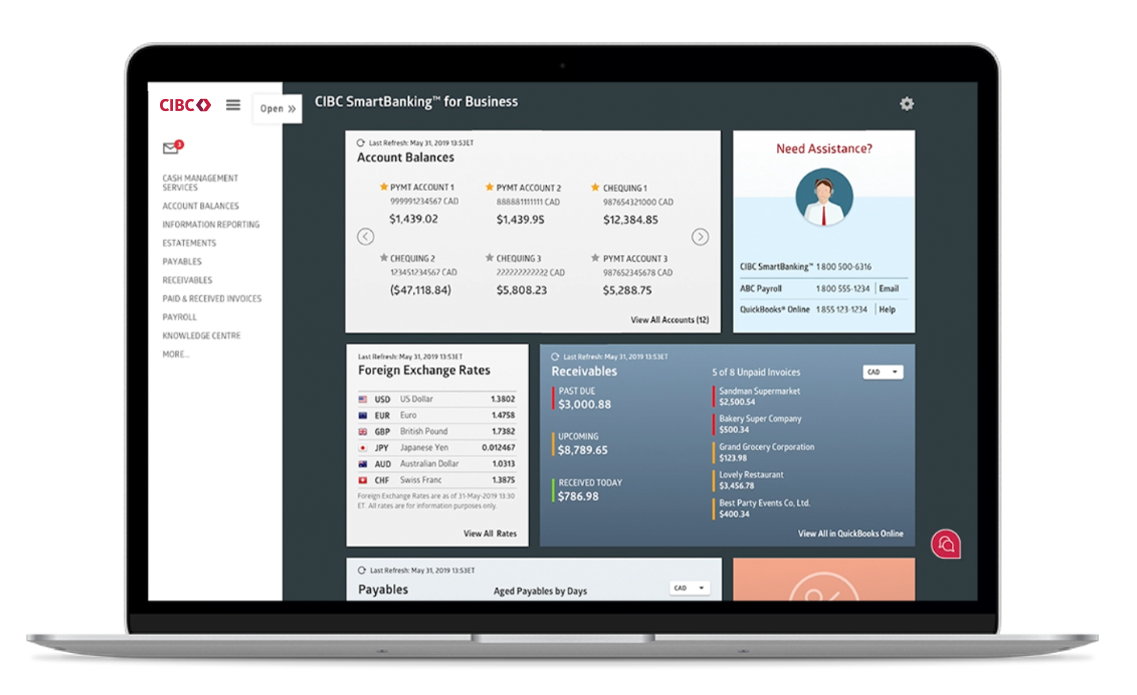

Streamline your cash flow

Keep track of your ins and outs with our easy-to-use cash management services — collect money from customers and pay employees and suppliers.

Best Bank for Cash Management in Canada

Global Finance Magazine

2021, 2020, 2019, 2018, 2017

Your cash management questions answered

Advice and resources

Grow your business

We'll help you get funding so you can cover day-to-day or large expenses, protect your business from unexpected cash shortfalls and plan for the future.