Take control of your credit

Track your finances

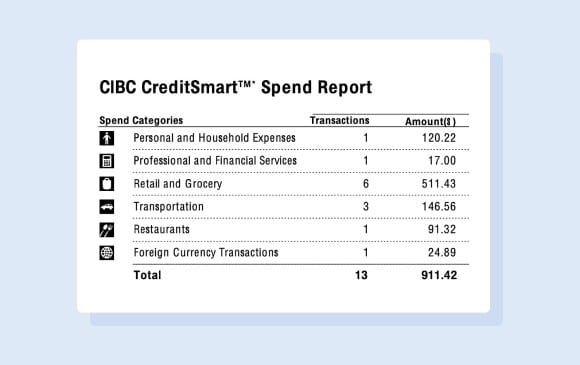

Get a detailed overview of your credit card spending in your monthly statements.

Manage your spending

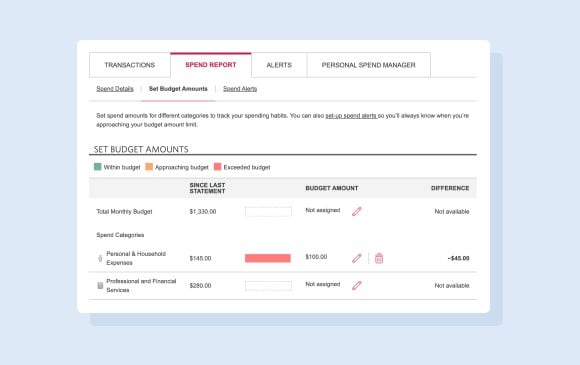

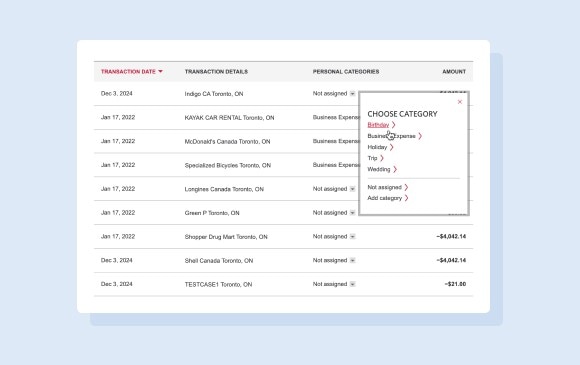

Create customized budgets and personal spend categories with a CIBC CreditSmart Spend Report and a CIBC CreditSmart Personal Spend Manager.

Set up alerts

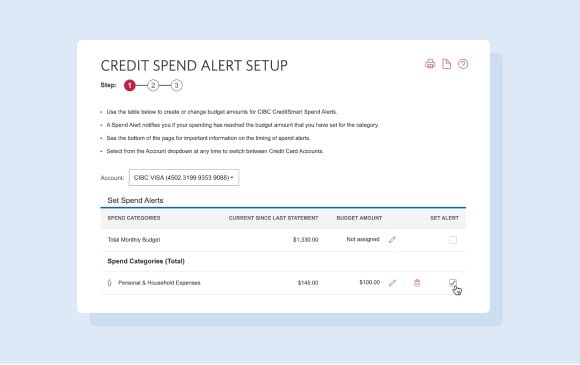

Get notified if you exceed your customized budget with CIBC CreditSmart Spend Alerts.

Stay on top of your budget with CreditSmart’s features

Monthly statements

Spend reports

Spend alerts

Personal spend manager

Become a credit expert

Paying off your credit card debt

With a solid plan and some dedication, you can pay off your card debt and reach your financial goals faster.

How to avoid missing credit card payments

Follow these simple tips to avoid late credit card payments and unnecessary interest charges on your CIBC cards.

Keep track of your accounts with alerts

Learn how to set up alerts and customize the account activity you want to monitor — we’ll take care of the rest.