We’re working on making additional account details for your CIBC Investment Account available through online banking. These enhancements will be available in phases and will include detailed account information such as transaction history, a visual summary of your asset breakdown, rate of return, plan contributions and withdrawals, beneficiary information, and trusted contact person. These will become available as follows:

- Fall 2027

- Transaction history

- Beneficiary information

- Contribution summaries and withdrawal information

- Grant and notional information for RESPs and RDSPs

- Trusted contact person information

- Minimum and maximum and elected payment amounts for LIFs and RIFs

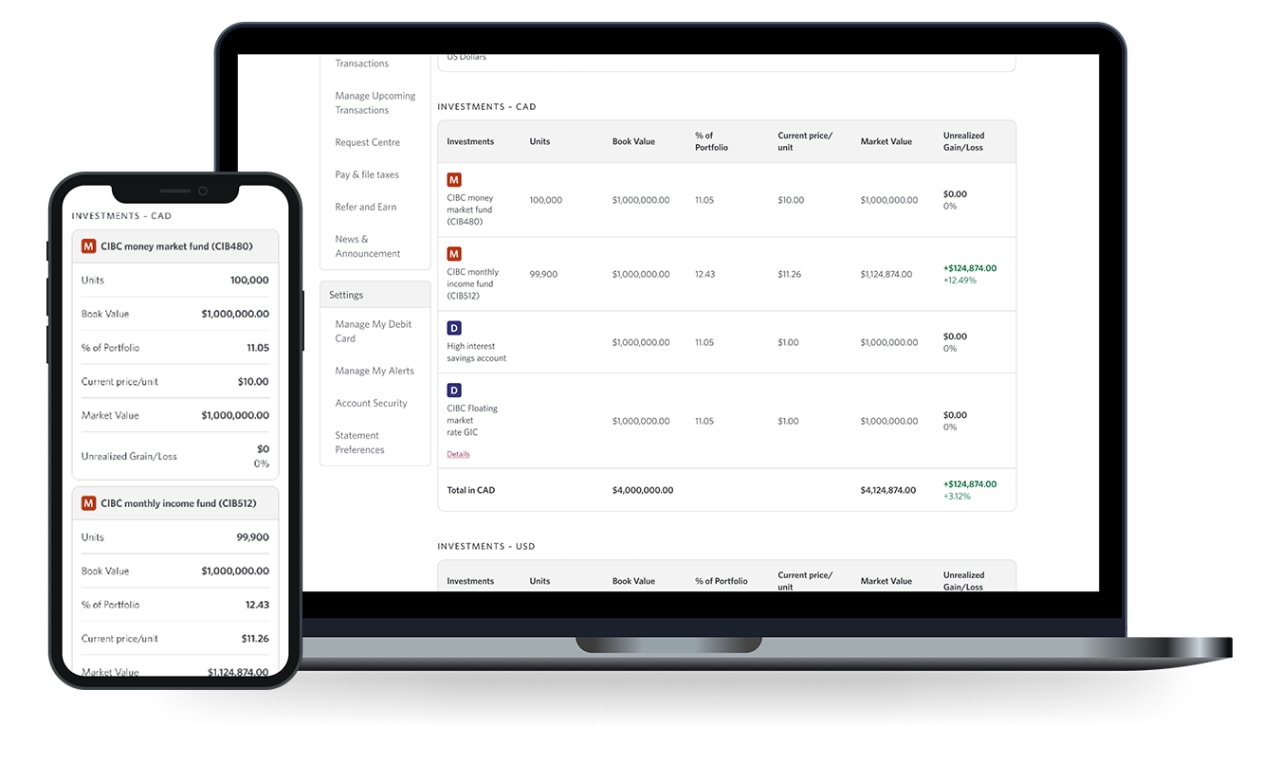

In the meantime, account holdings are available through online and mobile banking already, while your transaction history can be found on your statements, available online through My Documents. You can also find more up-to-date information by contacting your advisor or CIBC Telephone Banking.