Easily pay your friends and family, landlord or contractor

Start using Interac e-Transfer

What you’ll need

How-to guides

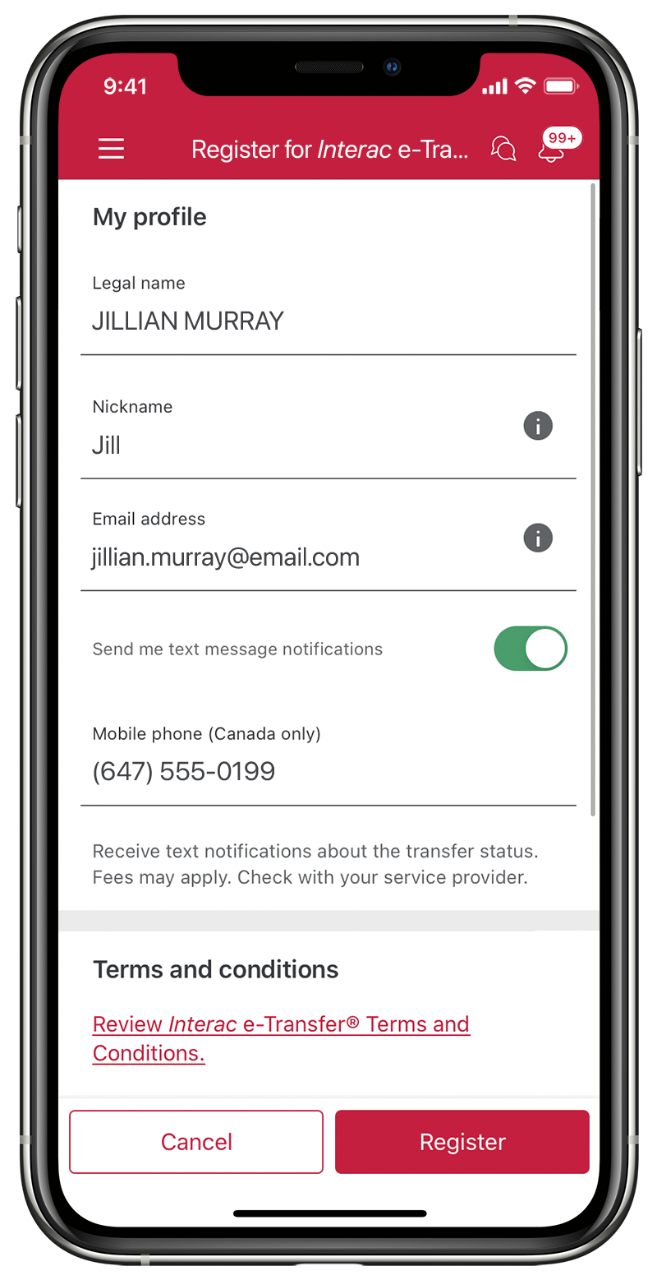

Register for Interac e-Transfer

Step 1

Step 2

Step 3

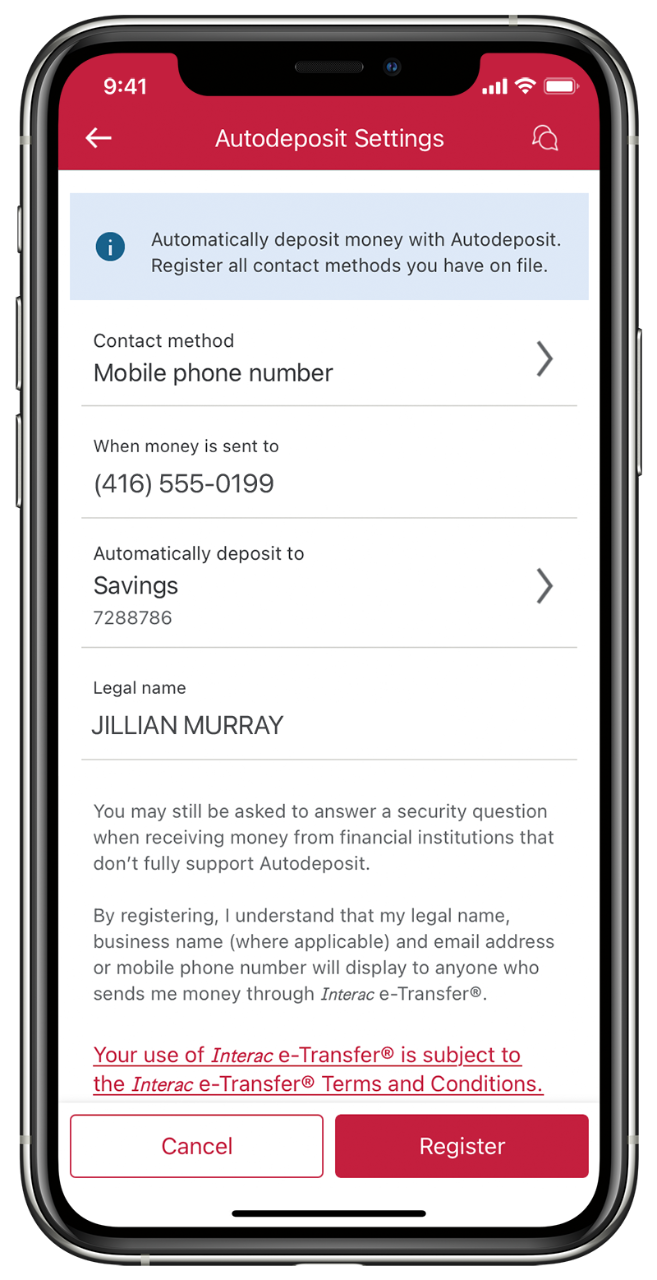

Register for Autodeposit

Step 1

Step 2

Step 3

Note: You can’t use the same email address or phone number to register more than one account for Autodeposit.

Step 4

Step 5

How to add a contact and send money

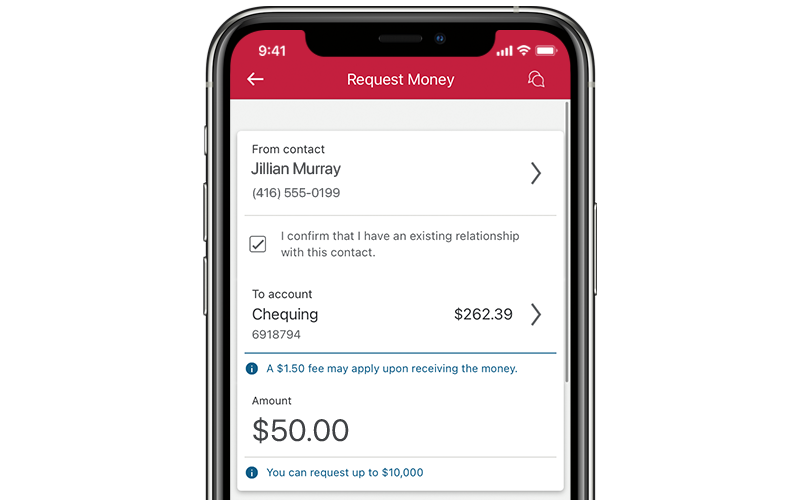

Request money

Step 1

Step 2

Step 3

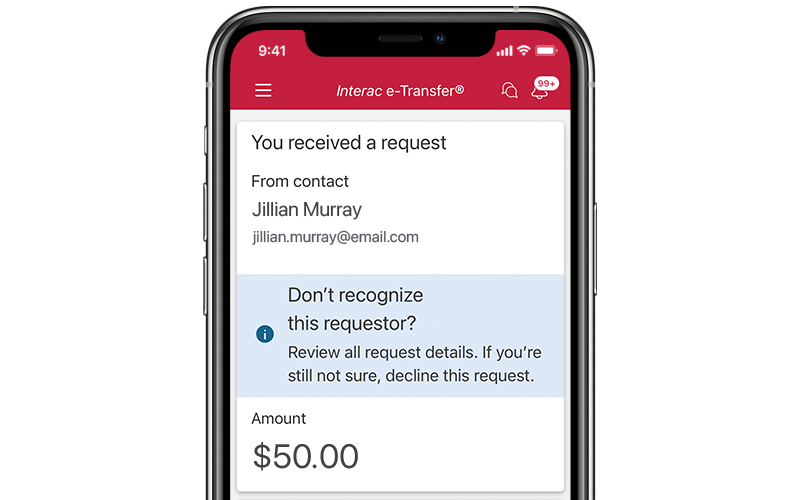

Fulfill a request for money

Step 1

Note: Before you select any link, make sure the email is expected and from someone you know on behalf of Interac e-Transfer.

Step 2

Step 3

Step 4

Step 5

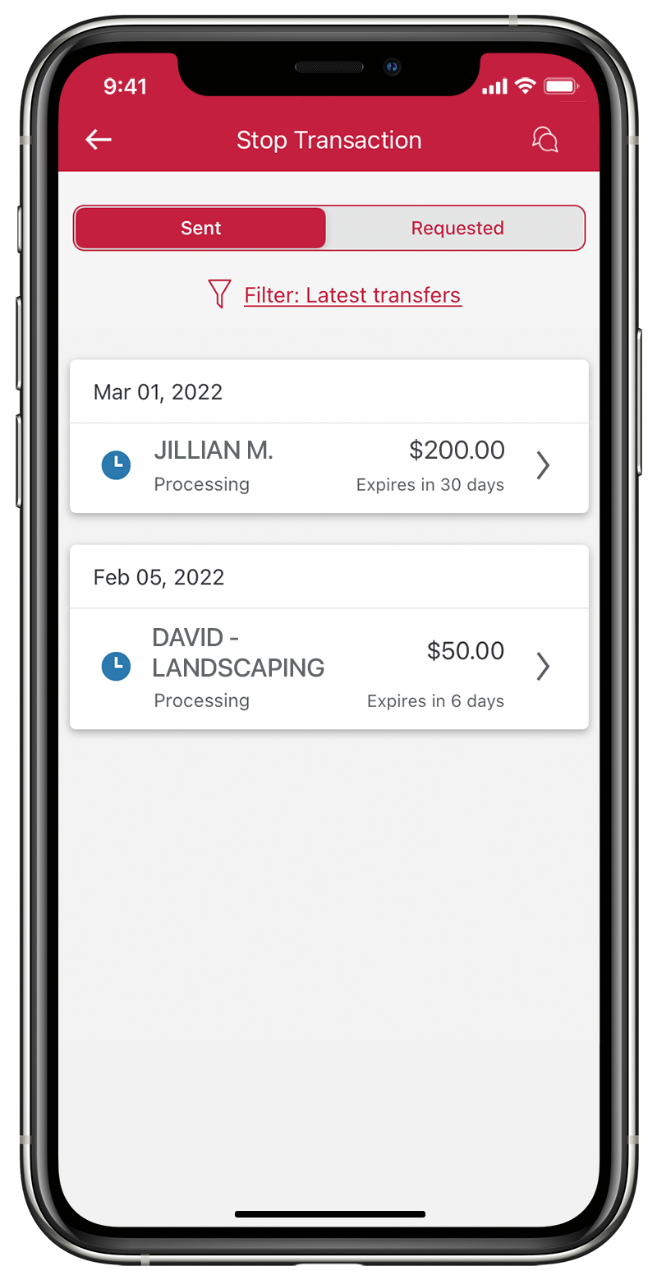

Stop a payment

Step 1

Step 2

Step 3

Step 4

Step 5

Step 6

Manage your transfers

Review transactions

Set up alerts

Check on upcoming transfers

Manage contacts

Fees and details

Interac e-Transfer fees

Included

with select bank accounts1

$1.50

per transaction2 to send or request money for all other accounts

Free

to receive money

Stop transaction fee

$3.50

to stop a transaction sent from Interac e-Transfer

Amounts you can send

No minimum

Up to $3,000

within a 24-hour period

Up to $10,000

within a 7-day period

Up to $30,000

within a 30-day period

More ways to move money

More ways to move money

Send, receive and deposit money — near or far

Ready to send money using Interac e-Transfer?