CIBC Smart Planner and Insights Terms (“Terms”)

Things you agree to when you use CIBC Smart Planner:

1. Services We are Offering

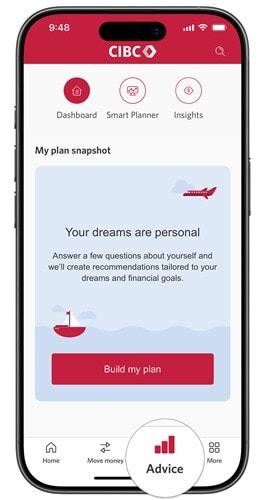

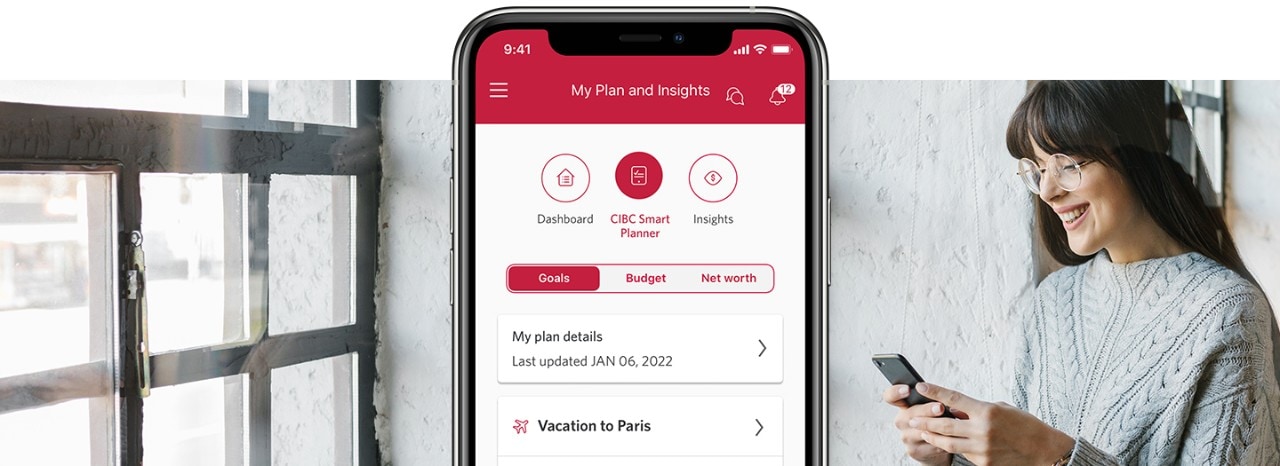

Canadian Imperial Bank of Commerce (referred to also as “CIBC”, “we”, “us” and “our”) are offering you financial tools, such as CIBC Smart Planner, Insights and other tools, which we refer to as Services, to help you manage your finances and plan your financial goals. Your access to and use of the Services is governed by these terms so please read them carefully. Please see Section 11 - Definitions for any capitalized terms not otherwise defined.

Under these Terms, the Services include the features, functionality, content and information provided by us through CIBC Mobile Banking and at CIBC Banking Centres and include any services that may be provided by our third-party service providers.

Two key Services currently provided include CIBC Smart Planner and Insights. We will also provide more budgeting tools and other financial advice tools as our Services evolve.

2. No Changes to Other Agreements You Have with Us

Where applicable, the Terms apply together with the CIBC Electronic Access Agreement (EAA). Your use of your Sign-In Credentials to authenticate yourself and register for the Insights service is subject to the EAA. In the event of any conflict or inconsistency between provisions contained in the Terms and provisions in any other agreement, provisions contained in the Terms will govern and control. Absent an express change, the Terms do not change any other agreement you have with us, including the EAA, your privacy consents or preferences and CIBC’s applicable policies.

3. Highlights of the Services

The Services refer to the features, functionality, content and information available in Insights, budget tools, CIBC Smart Planner and any other financial tools we may make available to you through this platform. When we reference “Services” we also mean CIBC Smart Planner and Insights.

Using your Account Information and/or any information you provide, CIBC Smart Planner, Insights or other budgeting and financial tools can automatically generate personalized reminders, recommendations, spending forecasts, financial and budget goal tracking and more. It is important to keep in mind that the information may not be up to date or reflect a complete picture of your finances. The information and recommendations you receive through the Services are for illustration purposes only and should not be relied upon.

The Services, CIBC Smart Planner and Insights may not be accessible at all times. In addition, functionality, features content or information may change, and may not always be available.

4. Fees

There are no fees to access CIBC Smart Planner, Insights or to use the Services.

Your ability to access CIBC Smart Planner, Insights and to use the Services depends on you having an appropriate active data plan and service for your Electronic Device and/or you visiting a CIBC representative at a CIBC Banking Centre for in-person consultations. If you choose to access the Services through your Electronic Device, it is your responsibility to determine if your wireless carrier provides and/or supports data plans and Internet browsing as applicable to the Services. You understand that CIBC Smart Planner, Insights or any component of the Services may no longer be available in the event that the data, or other services, for your Electronic Device terminates, lapses or is suspended. You are responsible for all costs, fees, data plans and related charges associated with your use of Electronic Device(s), and they are not reimbursable by us.

5. Privacy

CIBC Smart Planner, Insights and other budgeting and financial tools use your personal information to help you plan your goals and calculate your progress, and may suggest articles and product information that may be of value to you.

By using the Services, you consent to the collection, use and sharing of your personal information as described in CIBC Canada Client Privacy Policy, Your Privacy is Protected, available at any CIBC Banking Centre or cibc.com.

6. Changes

We may amend, suspend or terminate all or any part of the Services or change the Terms at any time with or without notice unless notice is required by law. CIBC may notify you of such changes by sending you a notice (written or electronic), posting a notice in CIBC Banking Centres, displaying a notice on or near CIBC ATMs, or in any other manner, which we may determine from time to time. If you use CIBC Smart Planner, Insights or access the Services after a change to the Terms or the Services, or after we have notified you of a change, it will mean you have accepted the change.

7. Termination

With or without prior notice, we may terminate your access to CIBC Smart Planner, Insights and/or the Services at any time and for any reason including, but not limited to, if you breach the Terms, if you use Insights and/or the Services for any unauthorized or illegal purposes or you use Insights and/or the Services in a manner inconsistent with any procedures or instructions we establish from time to time, in which case the Terms will continue to apply in respect of past access. We will not be responsible for any loss or inconvenience that may result in such suspension or termination.

If you wish to terminate Insights:

If you wish to terminate Insights, please turn off Insights on your Settings screen in Mobile Banking.

8. No Warranty and Exclusion of Liability

For the purposes of this Section, “CIBC” means CIBC and its agents, contractors, distributors, channel partners and associated service providers, and each of their subsidiaries. All the parties listed in the preceding sentence are third-party beneficiaries of this Section. The provisions set out in this Section shall survive termination of the Terms.

We are providing you with CIBC Smart Planner, Insights and the Services on an “as is” and “as available” basis and do not make any representations or provide any warranties concerning them. Without limiting the foregoing, we expressly disclaim all warranties, with respect to CIBC Smart Planner, Insights and/or the Services. No advice or information obtained by you from us through or from CIBC Smart Planner, Insights and/or the Services will create any warranty not expressly stated in the Terms. We do not provide tax, legal, or investment advice, or investment brokerage services through Insights or the Services, and you may not rely on it for any such purpose. You are responsible for your choices in using any recommendations made in conjunction with CIBC Smart Planner, Insights, the Services or Account Information.

You are solely responsible for all information or content that you give us through CIBC Smart Planner, Insights and the Services and you acknowledge that the information or content you provide is used in calculations and financial information presented to you. This information is only updated when you provide new information, may not be a complete picture of your finances and should not be relied upon.

Except as provided in the EAA or as required by applicable law, we will not be liable to you for any Losses arising from Insights and/or the Services which include, but are not limited to: (i) unsecured communication being inaccurate, intercepted, reviewed or altered by others, or not received by you, (ii) any delay or inability to access the Services, regardless of the cause of action, including negligence, even if we are advised of the possibility of damages, (iii) your failure to receive or view any communication that has been presented to you, or (iv) your failure to fulfill any of your obligations under the Terms, or to comply with any instructions we may provide to you from time to time.

9. Governing Law

Except for residents of Quebec: (a) the Terms are governed and interpreted in accordance with the laws of the province of Ontario and the applicable laws of Canada; and (b) you agree to submit to and be bound by those laws and the courts of Ontario in the event of any dispute relating to the Terms.

For residents of Quebec: (a) the Terms are governed and interpreted in accordance with the laws of the province of Quebec and the applicable laws of Canada; and (b) you agree to submit to and be bound by those laws and the courts of Quebec in the event of any dispute relating to the terms. Any judgment we obtain will not affect your obligations under the Terms.

10. Severability

If any provision of the Terms shall be held to be illegal, invalid or unenforceable by a court of competent jurisdiction, the remaining terms shall remain in full force and effect.

11. Definitions

To the extent that a definition in the Terms conflicts with a definition in the EAA, the two definitions shall be read together, failing which the definition(s) in the Terms shall govern.

- “Account Information” means account type, account number and balance and transaction information regarding Available Accounts.

- “Available Accounts” means accounts held with CIBC which we allow you to use for the purposes of the Services.

- “CIBC”, “we”, “us” and “our” means Canadian Imperial Bank of Commerce.

- “EAA” means the CIBC Electronic Access Agreement.

- “Electronic Device” means any electronic device that we allow you to use to access CIBC Smart Planner, Insights and the Services including, a personal computer, cellular phone, telephone, smart phone, wearable device or personal digital assistant.

- “including” means including but not limited to.

- “Losses” means any and all damages, claims, fines, penalties, deficiencies, losses, liabilities (including settlements and judgments), costs and expenses (including interest, court costs, reasonable fees and expenses of lawyers, accountants and other experts and professionals or other reasonable fees and expenses of litigation or other proceedings or of any claim, default or assessment), including, without limitation, indirect, incidental, special, punitive or consequential losses or damages, loss of profits, loss of revenue, loss of business opportunities, or any other foreseeable or unforeseeable loss resulting directly or indirectly out of the Terms, Insights or the Services provided to you, even if CIBC was advised of the possibility of damages or was negligent.

- “Mobile Banking” means any Web Site or mobile application, specifically designed by CIBC or a third-party service provider, through which you may sign on to Online Banking or Wealth Management Online for use through an Electronic Device.

- “Online Banking” means the online banking service offered by CIBC that allows you to view information and conduct transactions after Sign-In Credential authentication and includes access through Mobile Banking.

- “Services” means the features, various tools and functionality set out in the Services Section of the Terms and include CIBC Smart Planner, Insights and other financial tools that we may make available through CIBC Mobile Banking and CIBC Banking Centres.

- “Sign-In Credentials” means usernames, passwords, personal verification questions or other information required to access Online Banking, Mobile Banking, Insights and the Services.

- “Terms” means the terms and conditions.

- “You” and “your” means the person who is using CIBC Smart Planner, Insights, Services or other financial tools we make available from time to time.

Trademarks