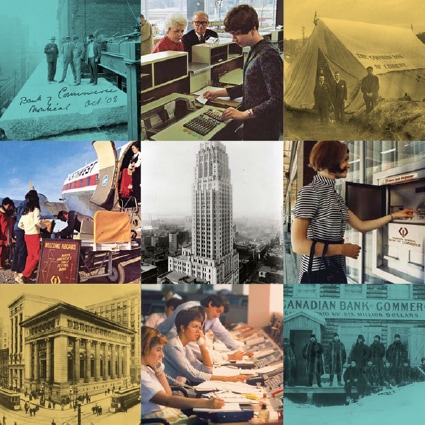

A Short History of CIBC

CIBC Archives