Limited time offer: Get $150 or more cash back with CIBC Investor's Edge.† Learn more about this limited time offer.

Are you under 25?

Are you a student over 25?

STEP 1

Open a CIBC Smart™ Account for students

Get a bank account with student benefits to enjoy unlimited transactions with no monthly fee.1

Refer a student and you’ll both get rewarded.

STEP 2

Open a CIBC Investor’s Edge account

Choose one or more of our account types depending on your investment goals.

The perks of investing as a student:

$0 annual fee

We'll waive the $100 annual fee for registered and non-registered accounts.

No minimum balance

Get started without worrying about maintaining a minimum balance.

$5.95 per online stock trade

Save on the regular rate of $6.95. Save on the online options trading too, with only $5.95 + $1.25 per contract.

Why start now?

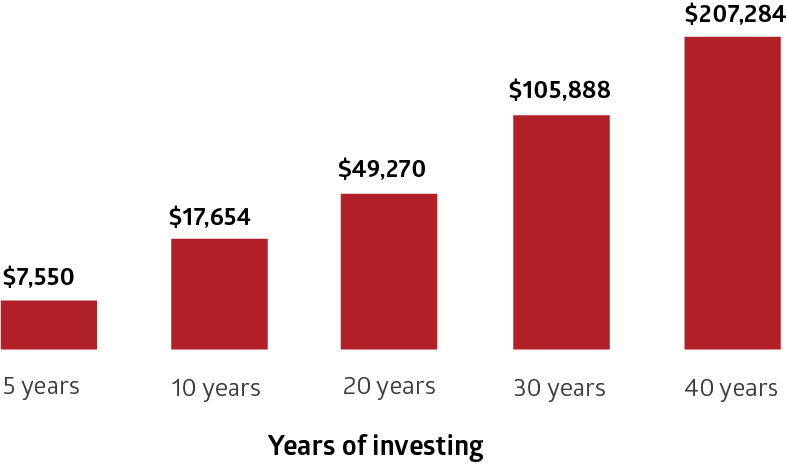

This is how investing early can pay off big-time:

If you start investing now by setting aside $25 every week, assuming a 6% rate of return, you’ll have about $7,550 in 5 years or more than $200,000 in 40 years.*

The longer you wait to start investing, the more you’ll need to set aside every week to reach the same amount.

Tax-Free Savings Account (TFSA)

- Pay no tax on interest, income or capital gains earned within your account

- Withdraw money tax-free at any time

Registered Retirement Savings Plan (RRSP)

- Lower your taxable income while investing for your long-term goals

- Pay no tax on the earnings and growth within your RRSP, until you withdraw money

Non-registered account

- Access your money easily

- Invest however much you want without worrying about reaching a maximum

Ready to start investing?

Investing 101

Understand the basics of investing and why it’s important to start early.

Your investing personality

Knowing what kind of an investor you are can play a major role in helping you put together your portfolio.

Managing your investments

Find tips on how to manage your investment portfolio.