How much cash can you get back?

| Your cash back | Your first Global Money Transfer |

|---|---|

| $35 | $100 - $9,999 |

| $100 | $10,000 - $29,999 |

| $300 | $30,000 - $49,999 |

| $500 | $50,000 - $69,999 |

| $700 | $70,000 or more |

Why you’ll love using CIBC Global Money Transfer

Transfer options to suit your needs

Send money to digital wallets around the world in minutes

Philippines

China

Kenya

Bangladesh

Send money to any bank account in 130+ countries.

Send money from your Canadian dollar account to the country’s local currency or to USD, or from your US dollar account to local currency

Now, send it in real-timeⓘ to eligible Visa* cards in over 80 countries.

All you need is their Visa* card number. Their money will be delivered in 30 minutes or less for Visa* debit cards and within 24 to 48 hours for Visa* credit cards.

Your loved ones can pick up cash at participating MoneyGram locations abroad, including India, the Philippines, Mexico, Jamaica and more. Send up to $2,000 per day and enjoy same-day delivery.

It’s easy to send money. Here’s how:

STEP 1

STEP 2

STEP 3

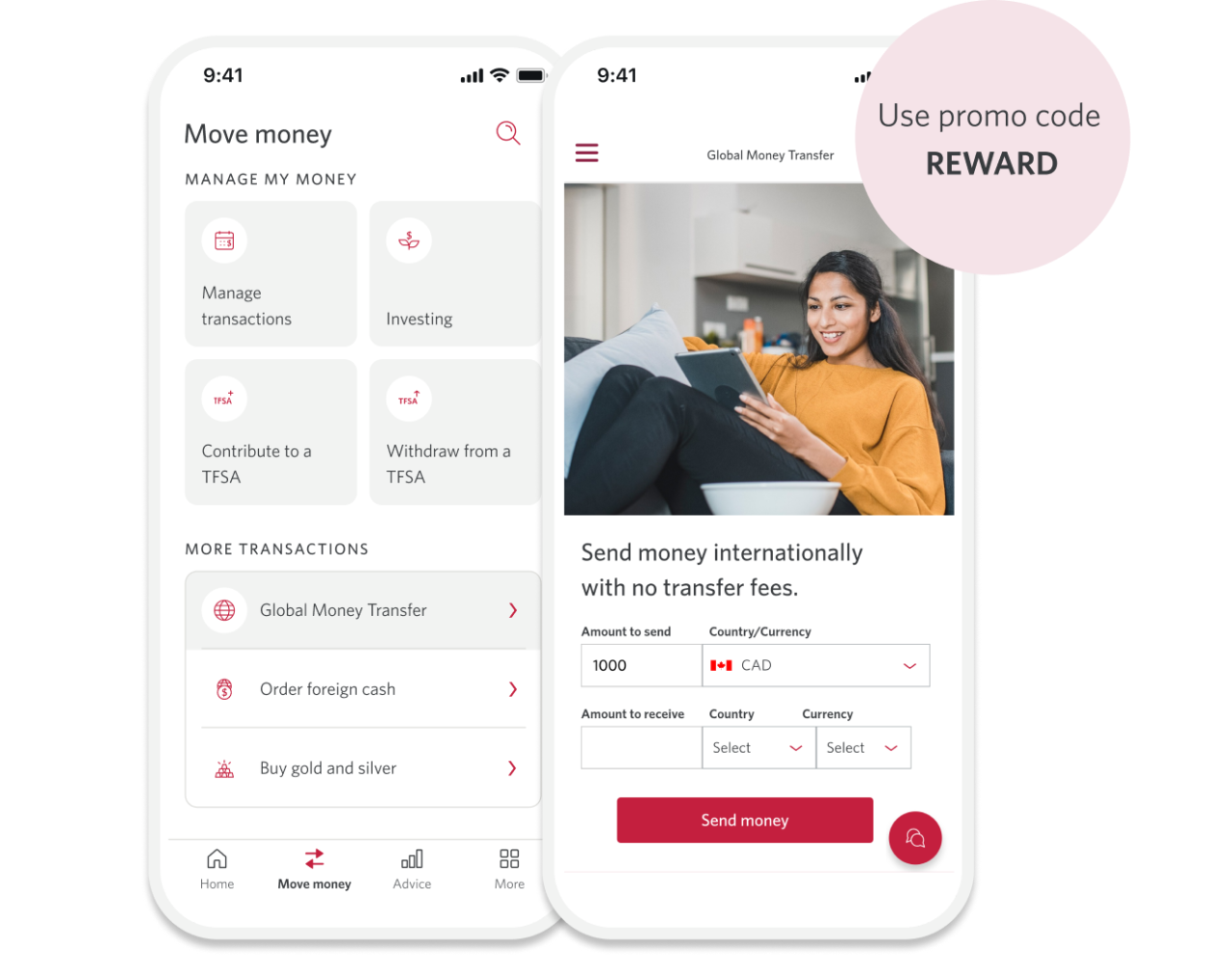

REWARD

Ready to send a CIBC Global Money Transfer?

Use promo code REWARD to get cash backⓘ after your first Global Money Transfer