What it means

An extra layer of security

Before you complete a sensitive request that requires greater protection, you’ll get a prompt to enter a one-time verification code.

After your password, it serves as a second check to make sure it’s really you accessing your account.

No more personal verification questions

Don’t worry about having to remember the answers to your personal verification questions anymore. The one-time verification code replaces them.

Unique verification codes

A new 6-digit one-time verification code is generated for each sensitive transaction or request, but you’ll only need to enter the code once during each online banking session.

Each code is unique, and we’ll never contact or ask you to reveal the code over the phone.

How it protects

How it works

STEP 1

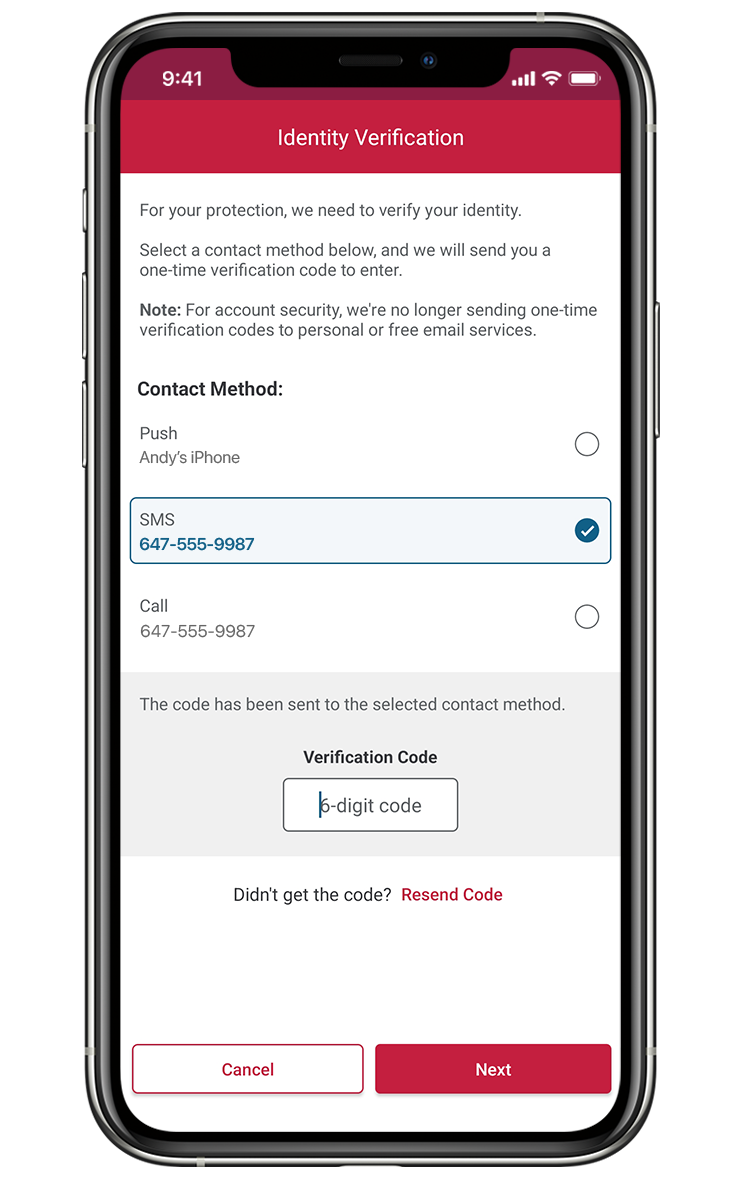

Select your contact method

Choose to get the code via text, push notification or voice call from the dropdown menu.

Note: For account security, we no longer send one-time verification codes to any email services and can’t leave a voicemail message.

Check which international numbers we can send verification codes to Opens in a new window..

Step 2

Enter your one-time verification code

Once you receive the code, enter it into the box to complete your transaction.

Note: Verification codes expire in 10 minutes, so enter it as soon as possible to complete your transaction. If you enter your 6-digit one-time verification code incorrectly 3 times in a row, the code will expire.

Fraud prevention

We want to protect you from scams. Fraudsters may contact you, pretending to be a member of CIBC’s fraud team. They may claim your account’s been compromised due to suspicious activity. They may also ask you to share a 6-digit one-time verification code with them to protect your account. If anything like this happens, disconnect the call immediately and call the number on the back of your card.

Learn more about banking fraud about how CIBC is supporting Ukraine.

Ways to receive the code

What to do before you travel

Review your settings

Make sure the device you’ll be travelling with is set up to receive push notifications. Keep in mind you can only enable push notifications on one mobile device at a time.

Confirm your contact information

Make sure your contact information is up-to-date. If you use a phone number registered to a region outside of Canada or the U.S., make sure it's an international number we can send verification codes to Opens in a new window..

When outside of a Wi-Fi network, make sure roaming is on, keeping in mind that data charges may apply.