Accessibility Quick Links

Small business 101

Grow, manage and succeed by mastering the basics of business banking.

How to

Learn how to put practical everyday strategies to work in your small business.

Financial tips

Get our latest economic reports and tips for navigating taxes, expenses and more.

Client stories

Get insights from other entrepreneurs who are on a business journey similar to yours.

CIBC ranked #1 for Small Business Banking Customer Satisfaction by J.D. Power.

Check out what's new

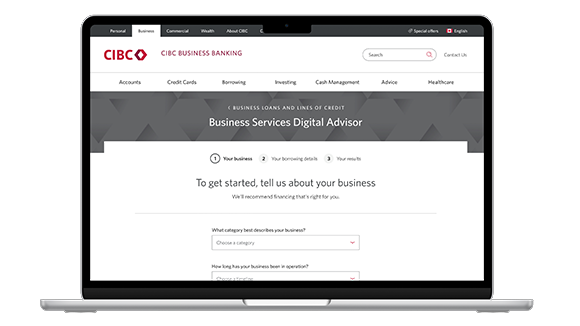

Business Services Digital Advisor