Accessibility Quick Links

How we’re supporting those affected by the ongoing conflict in Ukraine. Learn more about how CIBC is supporting Ukraine.

Why newcomers love CIBC

Bank anywhere with our mobile app or access our one of our many banking centres and ATMs conveniently located across Canada.

Earn cash back with credit card purchases. You don't need to provide an income or credit history, or a security deposit.

Send money back home with no fees1, get account updates in real time and tap to pay for purchases, all from your mobile device.

Your financial journey in Canada starts here

Get support that fits your unique journey

Moving to Canada and don't know where to start? Answer a few basic questions to get tailored resources, tips and banking offers with the CIBC Smart™ Guide to Canada.

Whether you're planning your journey, just arrived or already settled, we'll help you start your new life here.

Banking designed for your new life

Start saving and managing your money today with a CIBC Smart™ Account for Newcomers

Special offer

Pay no monthly fee for 2 years.†† Plus, get a $400 Costco Shop Card† after you open a CIBC Smart Account for Newcomers as your first CIBC chequing account.

Credit cards to meet your needs

You could get a higher limit‡ on your credit card. Whether you want cash-back, travel or reduced interest rates, we have a credit card that will fit your needs. Newcomer Banking applications do not require credit history or funds to be secured.

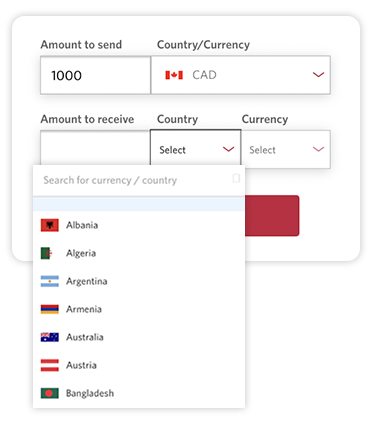

Send money back home with $0 transfer fees1

With CIBC Global Money Transfer™, it's safe and fast to send money to loved ones around the globe. You can pay using your eligible CIBC credit card or CIBC bank account.

Your newcomer journey at a glance

Step 1

Deposit accounts (chequing or savings)

Get started with your day-to-day banking needs including wire transfers and foreign cheque deposits.

Step 2

Credit cards

Go cashless, and even use your device to pay your purchases while earning points or cash back.

Step 3

Financial advice

Get advice from our advisors — they will work with you to make your ambitions a reality, like saving for a down payment for your home.

Step 4

Mortgage

Our team of Mortgage Advisors will help you buy your first home in Canada.

Track your spending to grow your savings faster

There's a lot to keep track of now that you're in Canada. With CIBC Insights, we help you see where your money is going and how to save more.

Ready to start banking in Canada?

Discover more resources for newcomers

What to do after you arrive in Canada

Learn how to make a budget

Send and receive money in Canada

Invest in your future in Canada

Save for your children’s education

Lending options for internationally-trained dentists

Koodo phone plan

CIBC Newcomer clients will receive an exclusive offer from Koodo to save money on their mobility plan, including free international long-distance minutes.

Pre-paid Koodo SIMs

Get 30 days of free Canada-wide Koodo service with a CIBC account, featuring 7GB + unlimited Canada-wide call and text.

Learn moreabout pre-paid Koodo SIMs for CIBC Newcomer clients.

Canoo

CIBC is proud to partner with Canoo to help Newcomers discover the best of Canada for free. The Canoo Cultural Pass provides newcomers with VIP access to over 1,400 of our country’s most exciting cultural and outdoor experiences.

Let's get in touch

Call us anytime

Book a meeting

Visit a branch or ATM